|

Instrument Regulators

|

Business Valuations

|

Corporate Valuations

|

Blockchain Valuations

|

|

Australian Financial Services Licence (AFSL) is mandatory for valuers who deal with financial valuations. The valuers who value financial instruments need to be licenced by financial regulators. Trilogy of financial securities include financial instruments (products), financial markets (transaction space) and financial institutions (players). Financial products are bought and sold by clients and trilogy facilitate the space for buyers and sellers. Australian Securities and Investment Commission (ASIC) is the main regulator of AFSL. ASIC issues licences and monitor valuers who value financial securities. There are other regulators who get involved depending on the purpose of the valuation. If the valuations are conducted for insurance purposes and/or lending, then the Australian Prudential Regulation Authority (APRA) can get involved. |

Business valuations are generally for small businesses. These can be sole traders, partnerships, “startups” and small unlisted companies. The valuer’s primary task is to value the business based on future maintainable earnings. Essential elements of goodwill are generally three fold. There is the business goodwill, the operational goodwill and the location goodwill. |

Corporate valuations are more complex than small business valuations. These are corporations generally that are listed or capable of being listed. They generally have a large number of shares or capable of having large number of shares. They generally have established cash flows, Multiple projects and may have the ability to change the organisation structure. Initial Public Offerings (IPO) falls in to this category. |

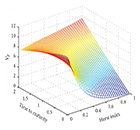

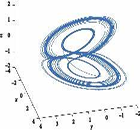

Blockchain valuations provide new challenges to valuers. There are multiple ways to value blockchains. These include but not limited to Store of Value (SOV), Token Velocity (TV), Metcalfe's law, Network Value to Transactions (NVT) Ratio, INET Model, Daily Active Addresses/Users (DAA), Notional Value to Market Value Ratio (NVMV) and Stock to Flow model. While these methods are used to value Blockchains, the underline principles need to be considered by the valuer at arriving the valuations. Term Volatility, Liquidity Risk, Framework Analysis, Check Method, Holding Period, Leverage, Transaction Filtering, Volume Filtering, Speculation Filtering, Influencer Filtering and Holder Pool are all important factors. While all of these assist the valuer in the valuation of the blockchain, the fundamental analysis of above applications needs to come from regression modelling, calculation of covariances, calculation of standard deviations, Coefficient of Variations, Correlation coefficient and Comparative Analytics. |

|

SOA and SOVA Valuations

|

Bond Valuations

|

Derivative Valuations

|

Decentralised Finance

|

|

Statement of Advice (SOA) is the document that outline the investment advice and Statement of Valuation Advice (SOVA) is the document that incorporate valuation with the SOA. SOVA is simply an extension of the SOA with the additional Valuation of the investments at the time the SOA is issued. There is no regulatory template for the SOA. However, the general guidelines of the content can be derived from the relevant legislations and statutory requirements. Corporation Act 2001 is a good starting point for the advisors to gain an insight in to the content of the SOA. Generally. things that need to be avoided in preparing a SOA is using of general advice. Avoid using general recommendations. Be specific about the advice. Consider client’s specific situation as to the background education, particular job that the client hold, family situation, cultural implications and etc. Ultimately, the client needs to accept the recommendation. Hence trust plays an important part of SOA. |

Bonds are a common financial instrument in investor’s portfolio. Suitability of the Bond in investors portfolio depends on the individual circumstances of the client. There is a misconception among the general public that the bonds are 100% safe. However, this is a fallacy. Even the sovereign bonds have been defaulted. There are mainly two issuers of bonds. Governments and corporate enterprises. Generally, the Government bonds are more secure, however the yields in these bonds are lower. It comes down to the risk and reward theory. Valuer need to take account all the factors in valuing bonds. What is the face value, what is the coupon return, when is the maturity and how the time discount is applied to the returns and what is the current interest rate and what is the market’s expectation of the future interest rates, are there any foreign exchange (FX) implications and other multiple variables that affect the bond value.

|

Derivative valuations depend on the underline interest that need to be valued. Derivative valuations are an important part of hedging. Futures Contracts need to be looked at from the point of it as of the date of the valuations. These contracts are generally without the influence of the governments and freely floated. Futures can be interest rate instruments, share market indices, company shares and currency instruments.

|

Decentralised Finance (DeFi) is the opposite of centralised finance. In a centralised finance framework, the trilogy is facilitated by the financial markets, instruments and the institutions. Institutions are regulated by a central banking authority (RBA) such as the reserves and prudential regulations are enforced by a regulatory authority such as Australian Prudential Regulatory Authority (APRA). Decentralised finance does not have a regulatory framework and handled by a shared consensus and trust of the users who facilitate smart contracts. The organisations involve are Decentralised Autonomous Organisations (DAO). There are two schools of thought on DeFi. The first contend the complete democratisation of the finance without the intervention of the institutions. The second proposition is more of a substitution. Despite the decentralisation, the institutions have not disappeared, rather been substituted. Crypto space today is filled with substituted institutions such as crypto exchanges, crypto information providers, crypto bankers (though they are not called banks). These are just the emergence of substituted institutions. |